Inflation is on everyone’s minds. Workers are concerned because even as inflation rises at the fastest rate in 40 years, their wages are not keeping pace.

Today, $300 in wages may buy a whole cart of groceries, but as inflation increases, that cart of food will shrink with time, and the faster inflation increases, the faster that cart will shrink.

If a worker’s wages don’t keep pace with inflation, their buying power diminishes along with any savings or reserves. Now, what if your income came from somewhere else instead of wages from employment, and what if that income kept pace with inflation? Then you would be shielded from the effects of inflation.

So, how do you hedge against inflation? By investing in assets that keep pace with inflation. What are these assets? Commodities and real estate.

People will always need commodities like food, and they’ll always need places to live and work. So, even as inflation rises at an annual rate of 7%, if the price of food or rent rises along with inflation, as history has shown, being invested in those assets would be a sure way to hedge against inflation.

What does inflation have to do with the title of this article?

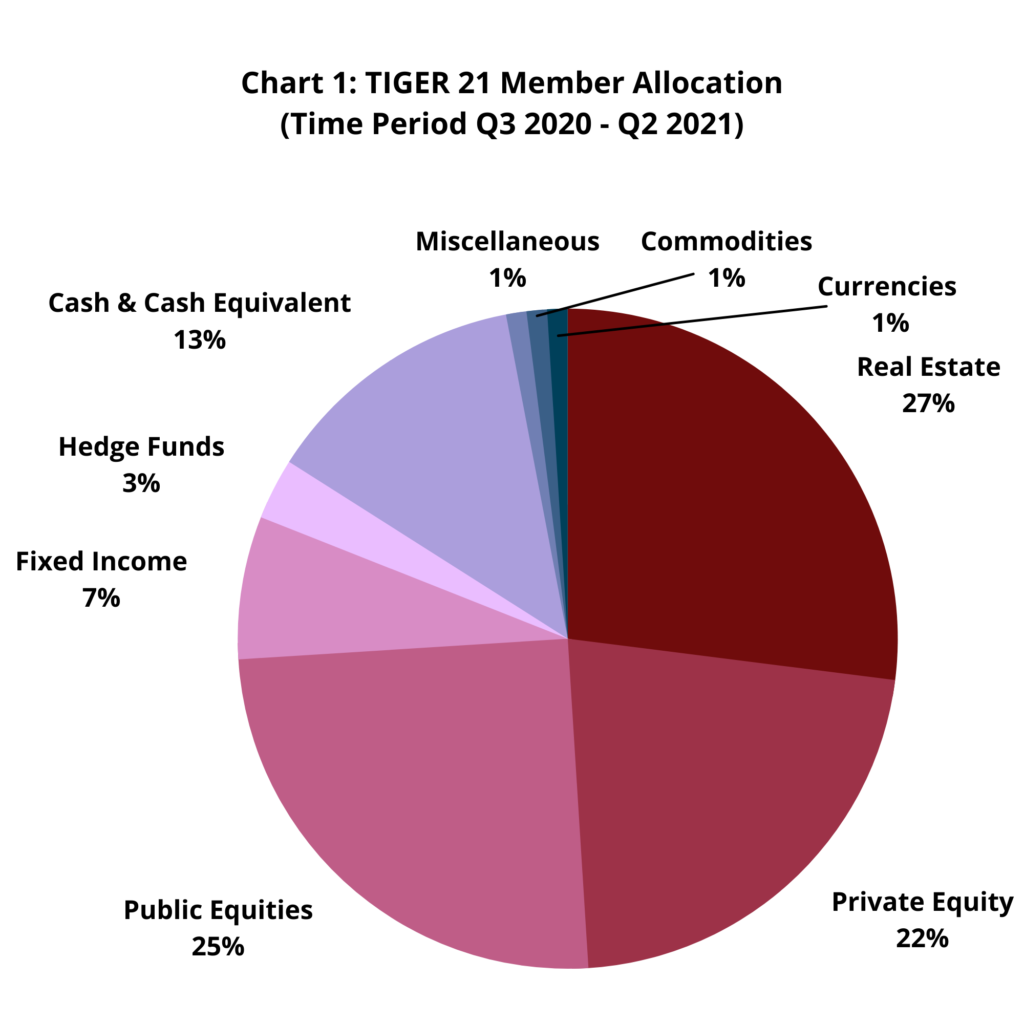

If you want to know where the ultra-wealthy are investing today or where they’re invested on an average day, take a look at the following chart:

The above chart is the latest Asset Allocation Report of Tiger 21, an exclusive ultra-high- social investing club whose members must have a minimum of $50 million in investable assets to join.

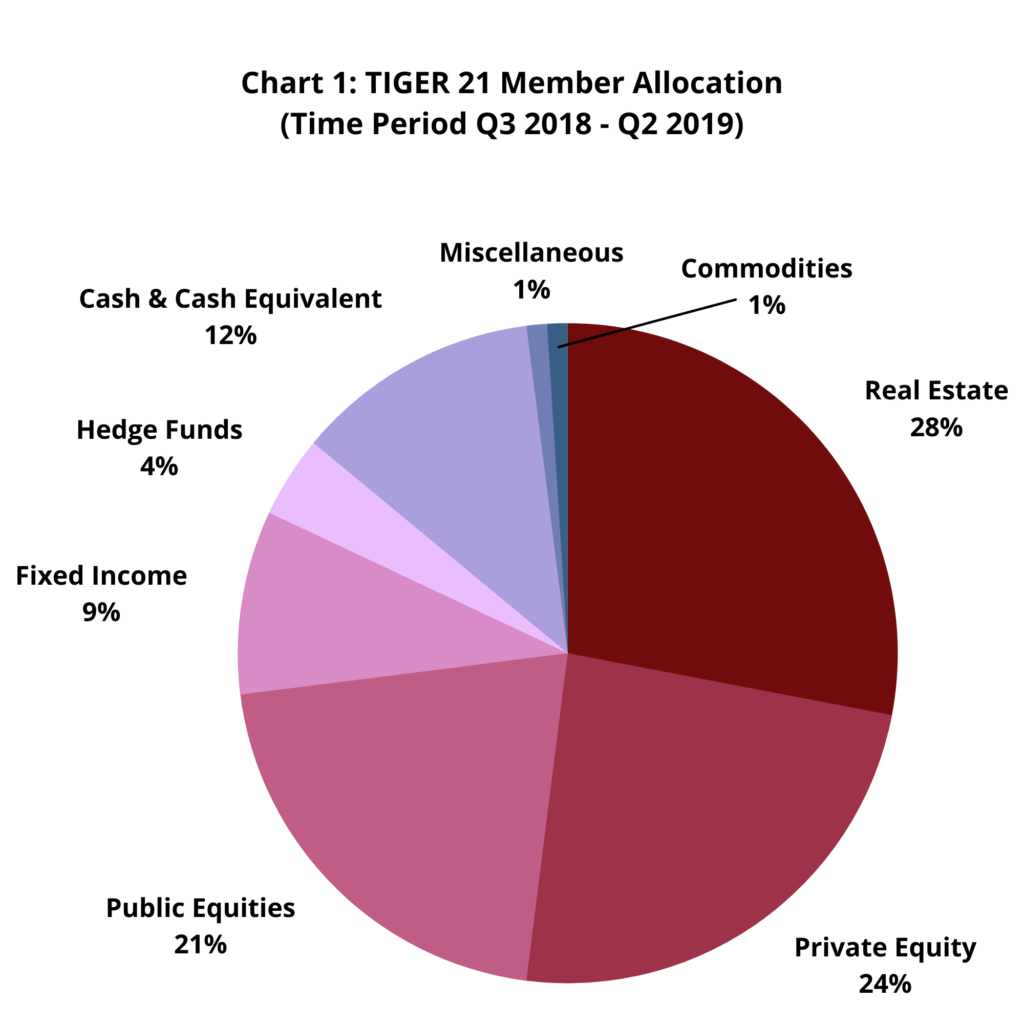

The asset allocation of the members for Tiger 21 doesn’t seem to change much from year to year, with real estate consistently taking the top spot and private equity a close second or third.

Together, real estate and private equity consistently account for most of their asset allocation.

Here’s an Asset Allocation Report from 2019 showing that real estate is still #1, with private equity at #2:

Why real estate and private equity?

Besides above-market returns, as discussed above, real estate is an ideal asset for insulating a portfolio from the effects of inflation. Even as the markets have been abuzz about inflation and rising prices, there has also been significant chatter about increasing rents. Rents that keep pace with inflation protect you from diminishing buying power.

Now, what about private equity?

Private equity is the ownership of private companies.

With private equity, the ultra-wealthy pattern their private company investing after real estate. They look for income-producing companies with a track record of success. They typically follow demand to – once again – insulate against inflation.

You may be asking, “But aren’t there companies on the stock market that sell commodities or essential goods and services?” True, but those companies aren’t insulated from widespread stock market volatility. That’s another reason for the ultra-wealthy preference for private companies.

Where are the ultra-wealthy investing today?

Answer: In the same two assets they’ve always favored – real estate and private equity.

Why?

Answer: To insulate above-market returns against inflation and market volatility.