Time and time again, you’ll see Wall Street touting stock market returns vs. real estate returns, but they’re not telling you the whole truth. That’s because they’re comparing a sector of real estate that sophisticated real estate investors have little interest in – single-family homes.

To skew the numbers in its favor, Wall Street will often compare the average annual returns of the S&P 500 against yearly increases in the median home value since 1940. Based on that criteria, the average annual return of the S&P 500 has been 9-10%, while the median home value has increased an average of 5.5% annually.

Wall Street will want you to believe that it’s an open and shut case… 9% beats 5.5%. End of discussion. Right? Not exactly.

Sophisticated investors invest in commercial real estate (CRE), not residential. Wall Street apologists will cherry-pick data to cling to their argument that stocks beat real estate when this objection is brought up. For example, they’ll compare the S&P 500 to public REITs or the S&P 500 to CRE EFTs to support their position that stocks beat real estate.

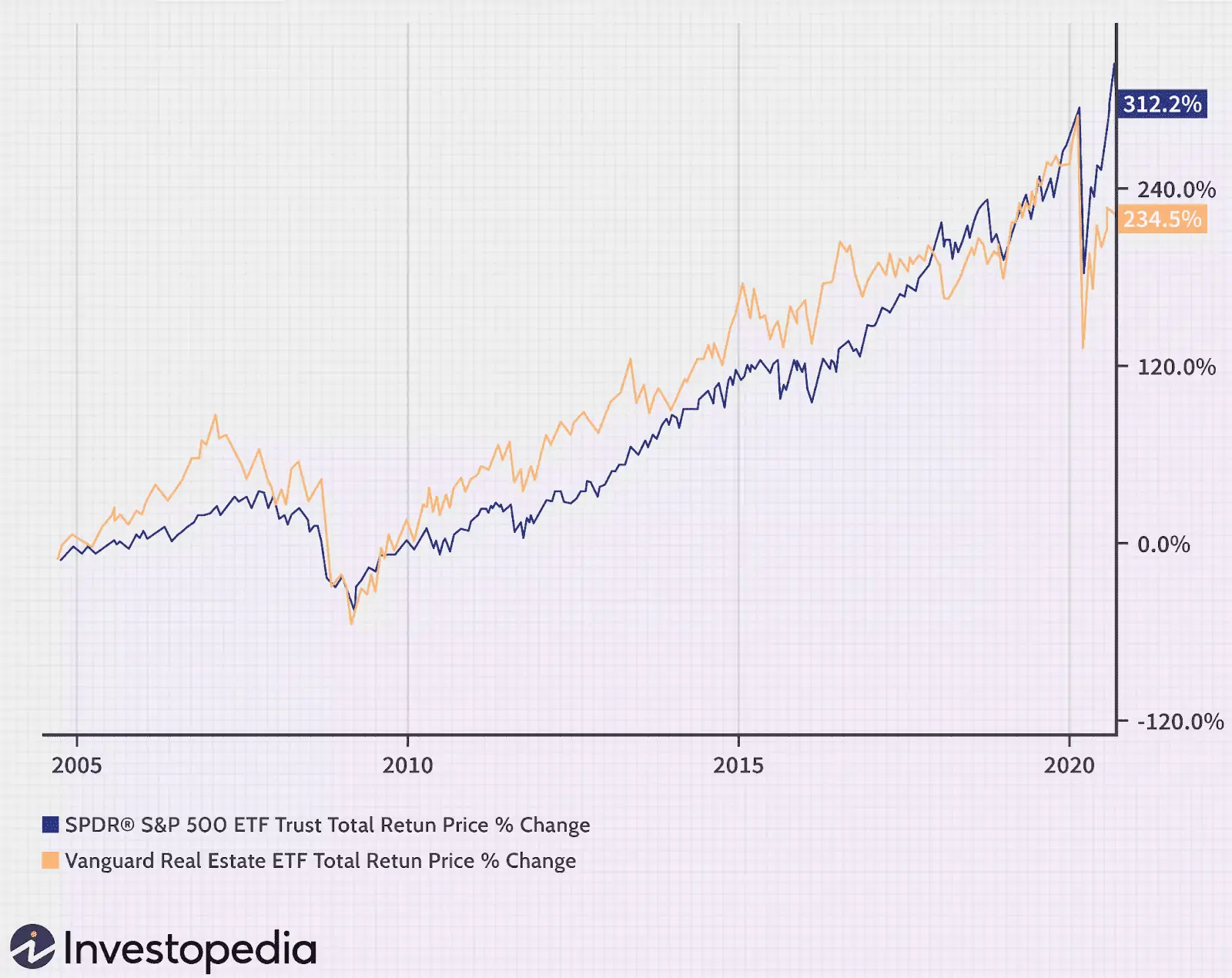

Take, for example, the following chart:

Wall Street wants you to believe that comparing an S&P 500 ETF and a commercial real estate ETF is a fair comparison of stock returns vs. commercial real estate returns, and that should settle the discussion, but don’t fall for Wall Street’s little lie.

The way Wall Street compares stock market returns vs. real estate returns is not an apples-to-apples return because it only considers appreciation when calculating returns.

When only considering appreciation, sure, stocks beat residential real estate, and sure, stocks beat CRE REITs and ETFs. Still, sophisticated investors don’t invest in residential real estate or CRE through public market offerings like REITs and ETFs.

Sophisticated investors want to avoid Wall Street volatility, so it makes more sense to invest in CRE through the private markets.

That’s why Wall Street comparisons of stocks vs. real estate are not fair and not an apples-to-apples comparison. Wall Street wants you to ignore much more to CRE investing, including rents and tax benefits, to skew returns in their favor.

Don’t be fooled by Wall Street articles touting stocks over real estate. Dig deeper. When coming across these types of articles, ask yourself the following questions:

What segment of real estate are they comparing to stocks?

-

- Single-Family.

- Multi-Family.

- Retail.

- Office.

- Industrial.

- Warehouse.

- Self-Storage.

- Office.

- Hospitality.

Are they comparing stock returns with returns of REITs and ETFs?

Are they taking into account private real estate performance?

What are they taking into account when calculating real estate returns? Appreciation? Income? Tax Benefits?

The problem with Wall Street comparisons between stock returns and real estate returns is Wall Street will often compare the returns of the S&P 500 against returns from residential real estate.

The problem is, most stock investors don’t invest in index funds, and sophisticated real estate investors don’t invest in residential real estate.

There is 25% of stock investors that are retail investors who trade stocks on their own. How does the average retail investor perform? According to J.P. Morgan Asset Management, the average retail investor loses half a percent a year from stocks when factoring in inflation.

The data is not favorable for investors who invest in stocks through professionals like mutual funds, ETFs and advisors, brokers, and planners. According to a 2020 report, over 15 years, nearly 90% of professionals (i.e., advisors, brokers, fund managers) failed to beat the market.

On the real estate side, sophisticated investors avoid residential real estate in favor of passive private CRE for income, appreciation, and tax benefits.

According to one of the leading passive CRE research firms, Prequin, the average annual return from funds with $200 million or less in assets under management was 11.2%. Prequin’s 11.2% estimate includes total returns from income and appreciation but doesn’t include tax benefits. Therefore, actual returns that take into account tax benefits are even higher.

A fair comparison of stock returns vs. real estate returns – tracking more real-world investment behavior – reveals results vastly different from what Wall Street wants you to believe, and that is: Passive CRE investments offer total returns far superior to anything Wall Street can offer.