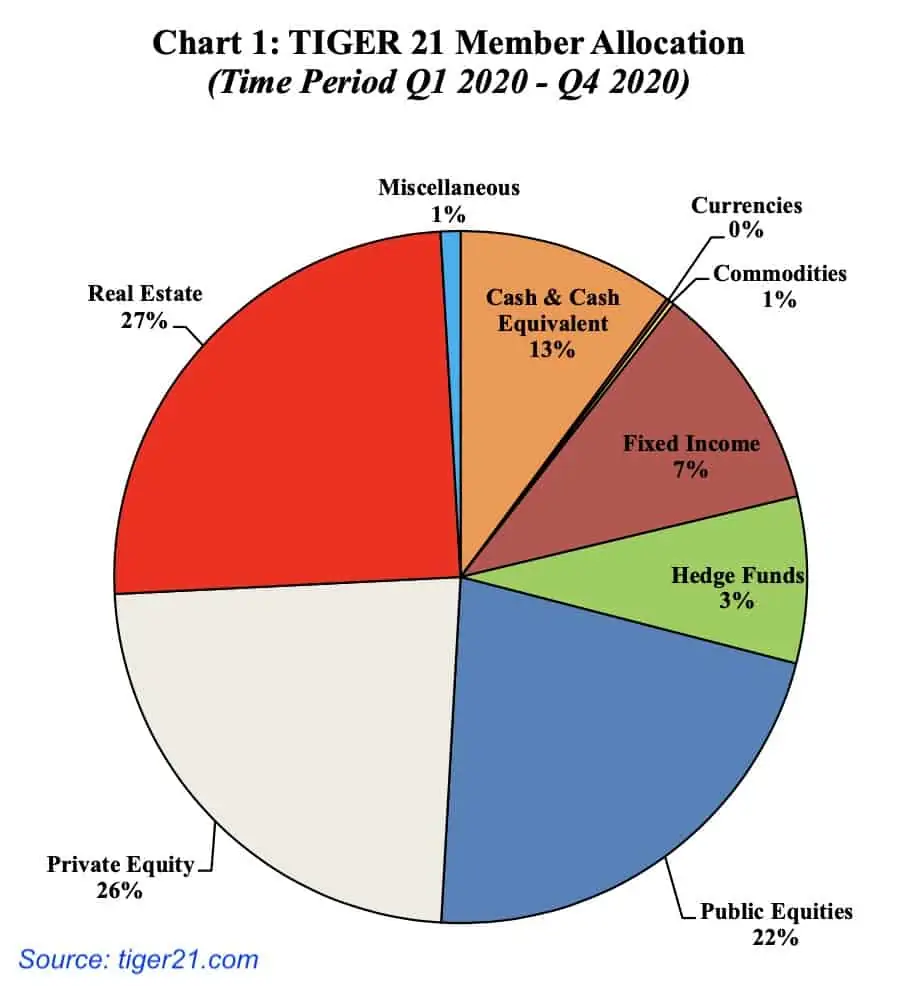

Among all assets allocated to the portfolios of the ultra-wealthy, like the members of social investing club Tiger 21 (minimum of $50M in investable assets to join), stocks come in third after real estate and private equity.

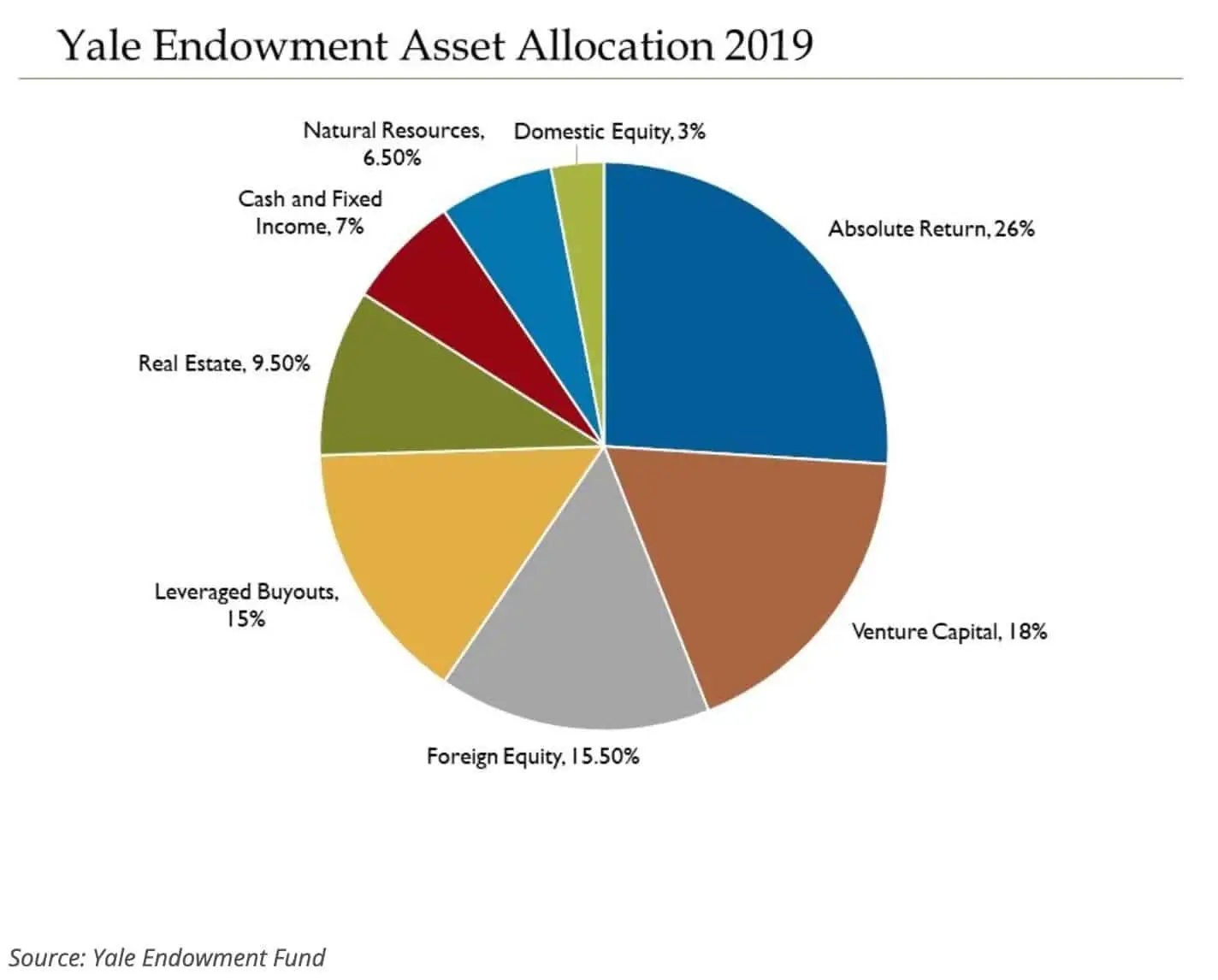

The 22% allocation by the wealthy to equities is close to the 18.5% allocation by Ivy League endowments like the Yale Endowment Fund.

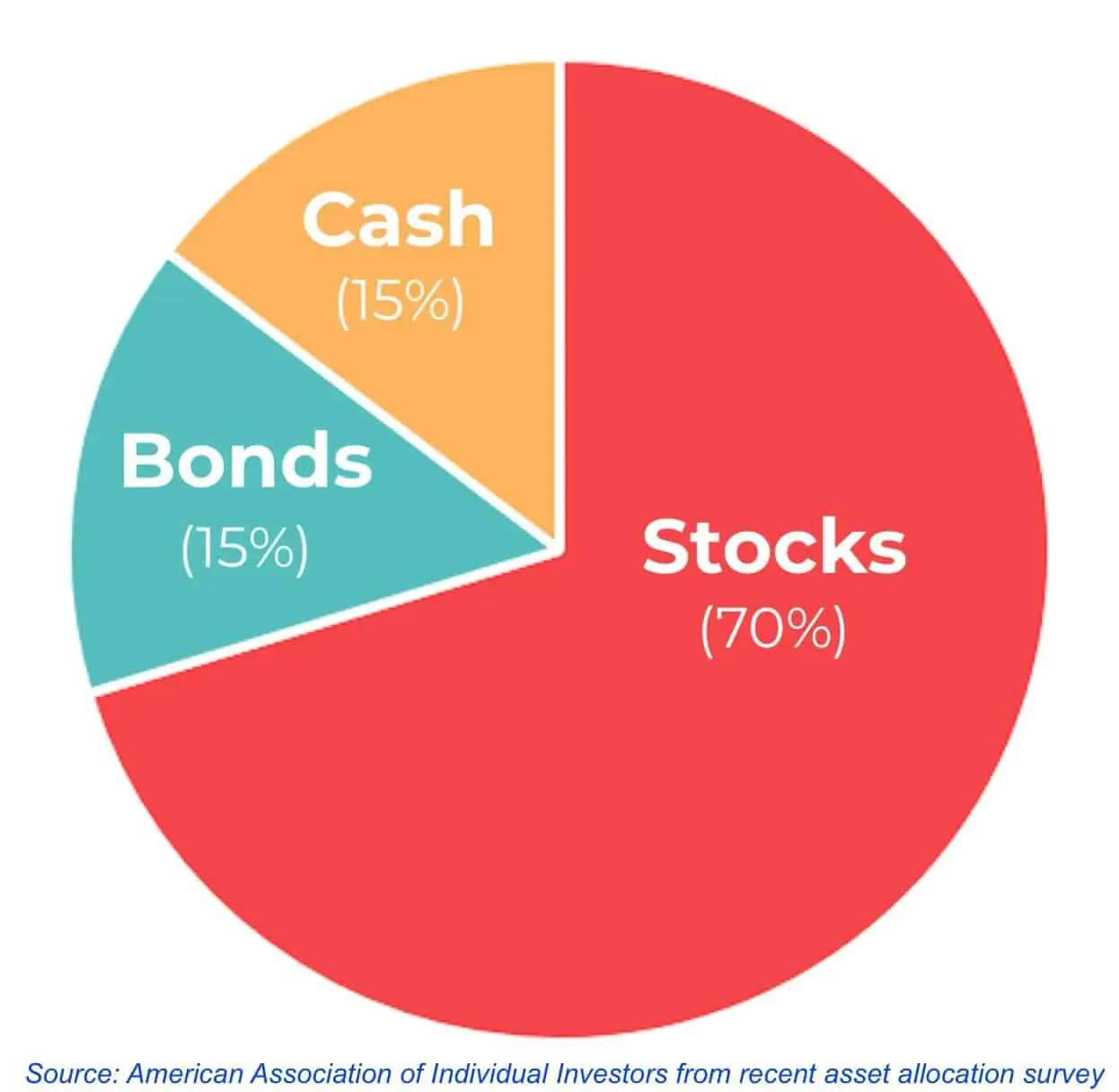

Compare the allocations of the ultra-wealthy with that of individual retail investors.

Why the disparity?

Why do average investors allocate most of their portfolios towards stocks while the ultra-wealthy relegate stocks to third on their list?

Because the ultra-wealthy and the middle class have different goals.

There are two differences between the ultra-wealthy and the middle class:

- The wealthy are investing and planning beyond their lifetimes.

- The wealthy ignore the noise.

The ultra-wealthy and institutional investors like the Yale Endowment have very different investing goals than the middle class. While the middle class are trying to scrape enough to get by in their retirements, the ultra-wealthy aren’t content to just get by. Instead, they want to live their best lives now and leave a financial legacy for their heirs and charitable causes for generations to come.

The ultra-wealthy are building multi-generational wealth while the middle class are building a nest egg for one generation – theirs. Endowments are no different than the ultra-wealthy. The goal of endowments is to generate income and cash flow to meet the current needs of the school, faculty, and students while preserving assets for future generations.

The ultra-wealthy and endowments are successful in their goals of generating enough income for present needs while preserving assets for the future.

So what is their preferred choice of assets? Income-producing tangible assets like private real estate and private investments (equity and debt) in companies that generate income and that have an underlying value that can appreciate over time.

However, with no cash flow and iffy appreciation that rises and falls with the broader markets, stocks are too unreliable for building and maintaining consistent wealth.

Income-producing assets like real estate and private equity that appreciate over time are ideal for meeting present needs while preserving wealth for future generations. That’s why the ultra-wealthy prefer these assets over stocks.

It’s also the other reason they can ignore the noise… By investing in long-term, illiquid assets, the ultra-wealthy can shut out all the market buzz and hype that impact the equities markets.

While the middle class hang on the words of talking heads on cable news, the internet, and social media, the wealthy keep their gaze fixed on the future. Tying their money up long-term affords them the ability to ignore short-term market developments and avoid following the herd.

There may be short-term dips, but they know that long-term, everything will iron out. So even now, as the markets are abuzz with inflation and recent bitcoin plunges, the wealthy sit back and ignore the noise.

Ask yourself why the wealthy place stocks third and place real estate and private equity on top.

What are your investment goals? Is it to get by on a 401k in retirement or build a legacy for future generations while living life without limits now?

If it’s the latter, you might consider allocating your portfolio more like the rich and less like the middle class with less emphasis on stocks and more focus on private investments.