Investments in alternatives are quickly going mainstream. Among institutional managers alone, alternative investment managers’ combined assets under management grew 5.1% to an all-time high of $7.4 trillion in 2020.

Alternatives were traditionally exclusive to the wealthy and connected. Still, because of education and recent changes to SEC regulatory provisions, alternative investment opportunities have not only become more open and discoverable but more accessible to more investors than ever.

Recent SEC regulatory changes, including the easing of advertising rules, implementation of Crowdfunding regulations that allow participation by non-Accredited Investors, and the expansion of the definition of an Accredited Investor, have all contributed to the increased attention and investment in alternative assets.

Ultra-high-net-worth investors (those with a net worth of at least $30 million) (“UHNWIs”) are heavily allocated to alternatives.

According to at least one source, 81% of UHNWIs are allocated to alternative investments, and among those UNHWIs, at least 50% of their portfolios are allocated to alternatives. Compare this to mainstream investors who allocate a majority of their portfolios to public equities and fixed-income products.

Alternatives entail a broad class of assets defined as anything other than listed equities or bonds. However, among UHNWIs, there are mainly two principal alternatives they are most interested in:

Ownership In Private Companies (private equity).

Real Estate.

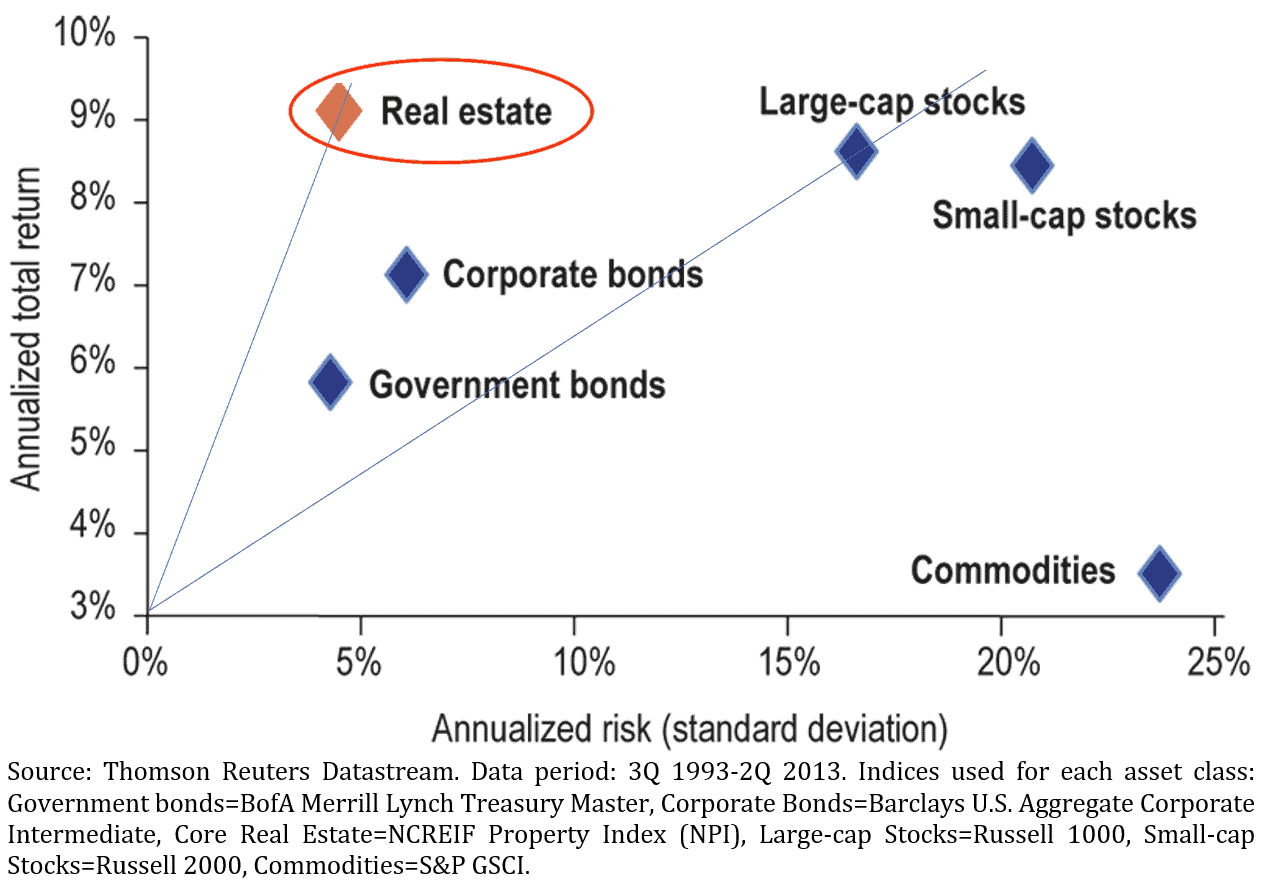

So why the interest in alternatives? UHNWIs are attracted to alternatives for their above-market risk-adjusted returns. For example, take real estate, which has a long track record of providing above-market returns at lower risk.

Alternatives like real estate and private equity have long attracted investors for advantages, including:

Cash Flow.

Appreciation.

Tax Benefits.

Recession-Resistance.

Besides all the preceding advantages of alternative investments, recent interest in alternatives has been driven by two other factors:

The Pursuit Of An Inflation Hedge.

An Interest In Impact Investing.

Inflation.

Real estate is consistently cited as a top asset as an inflation hedge.

The Top 5 Ways To Hedge Against Inflation.

How To Hedge Against Inflation With Investments That Keep Pace With Rising Prices.

Three Best Investments For Inflation.

Five Best Investments That Hedge Against Inflation And Others To Avoid.

Whereas stocks typically move in the opposite direction of inflation, real estate keeps pace with inflation – rents and values keep pace with rising prices. Real estate is among a class of essential goods that people will always need for shelter and work.

Even in hard times, people don’t stop needing a roof over their heads or a place to work. That is why real estate is typically cited as a top asset as an inflation hedge.

With recent rising prices and rising fears, it’s no surprise that investors are gravitating towards alternative assets like real estate to cushion the impact of future inflation.

Impact Investing.

Investors are no longer blindly throwing their money at public companies with questionable human rights and environmental records.

More and more investors want to make sure money goes towards ethical and responsible companies, and the alternative asset class offers them these opportunities. Investors are seeking to make an impact in various areas, including housing, healthcare, urban development, education, food and agriculture, energy, and the environment.

More and more investors are discovering what UHNWIs have known for decades – that alternative assets offer many advantages Wall Street assets don’t offer.

Now that alternatives are more discoverable and accessible, the mainstreaming of alternatives will only gain more and more momentum.