First of all, let’s get something out of the way…

Despite what you’ve heard anywhere else, your residence is not an investment. And until you sell it one day and extract any appreciation that may have accumulated over the time you owned it, your house is a money pit – continually requiring maintenance and upkeep expenses. And even when you do go to sell it, any home you acquire to replace it will also have gone up in price.

Just as your home is not an investment, single-family housing does not appeal to the savvy investor. That’s because renting single-family homes does not allow for economies of scale and fixing and flipping denies the investor an essential element of wealth-building – cash flow. That’s why the ultra-wealthy and savvy investors gravitate towards commercial real estate (CRE).

Why CRE?

Passive Opportunities. There are numerous opportunities in the CRE space in the private markets. Private companies which offer investors the opportunity to partner with them by pairing investor capital with their expertise allow these investors the opportunity to generate passive income streams – the golden fleece of wealth building.

Several articles on the web reveal multiple streams of income as the key commonality among self-made millionaires. Early on, these millionaires realized that making money in their sleep was the only path out of the rat race.

Reliable and Consistent Long-Term Cash Flow and Appreciation.

Investors who allocate to passive CRE are in for the long haul. Long-term, CRE is an ideal asset for delivering reliable income and appreciation – a valuable one-two punch for creating, growing, and maintaining wealth. With typical lockup periods of a minimum of 5-7 years, long-term passive CRE investments iron out temporary market dips.

COVID-19 and 2020 were prime examples where all but a handful of CRE segments (industrial, mobile home parks, affordable multifamily) saw dips and occupancies and rents but are all expected to make a full recovery by the middle of 2022.

Recession & Inflation Hedge. Specific CRE segments are ideal hedges against both recession and inflation. A CRE segment considered essential such as multifamily and affordable housing, will continue to deliver income – even in a market downturn as the pandemic demonstrated.

These same market segments are insulated against inflation because as overall prices rise, so will the cost of rent and the price of underlying land – without a dropoff in demand because of the essential nature of these assets. People don’t just stop needing shelter, food, fuel, and clothing in challenging economic times.

Tax Breaks. The tax benefits of passive CRE investments are numerous. From capital gains treatment of income and appreciation to the pass-through of deductions and depreciation, the tax advantages of passive CRE investments allow investors to enjoy the income and appreciation fruits of CRE investments and keep more of what they reap.

Leverage. Leverage allows investors to acquire more or bigger properties through commercial loans requiring only a fractional capital commitment (20%-25%). Instead of putting $1M into a single investment, hypothetically, an investor could use the $1M to take out loans to acquire four properties valued at $1M each ($250,000 down payment each) or one property valued at $4M.

A passive CRE investment allows the individual investor to invest in high-quality properties at a fraction of the price.

Should You Go All-In On Real Estate?

I don’t think there are many proponents of going all-in on CRE. In other words, not many sophisticated investors allocate 100% of their portfolios to CRE. Other assets such as income-producing businesses and agriculture offer many of the cash-flowing, appreciation, and tax benefits that CRE offers. It’s a good idea to consider these other assets for diversification purposes.

How Much Of Your Portfolio Should Be In Real Estate?

Now to answer the golden question… How much of your portfolio should be allocated to real estate? Well, if you want to mirror successful investors like the ultra-wealthy, the answer seems to be a minimum of about 25%.

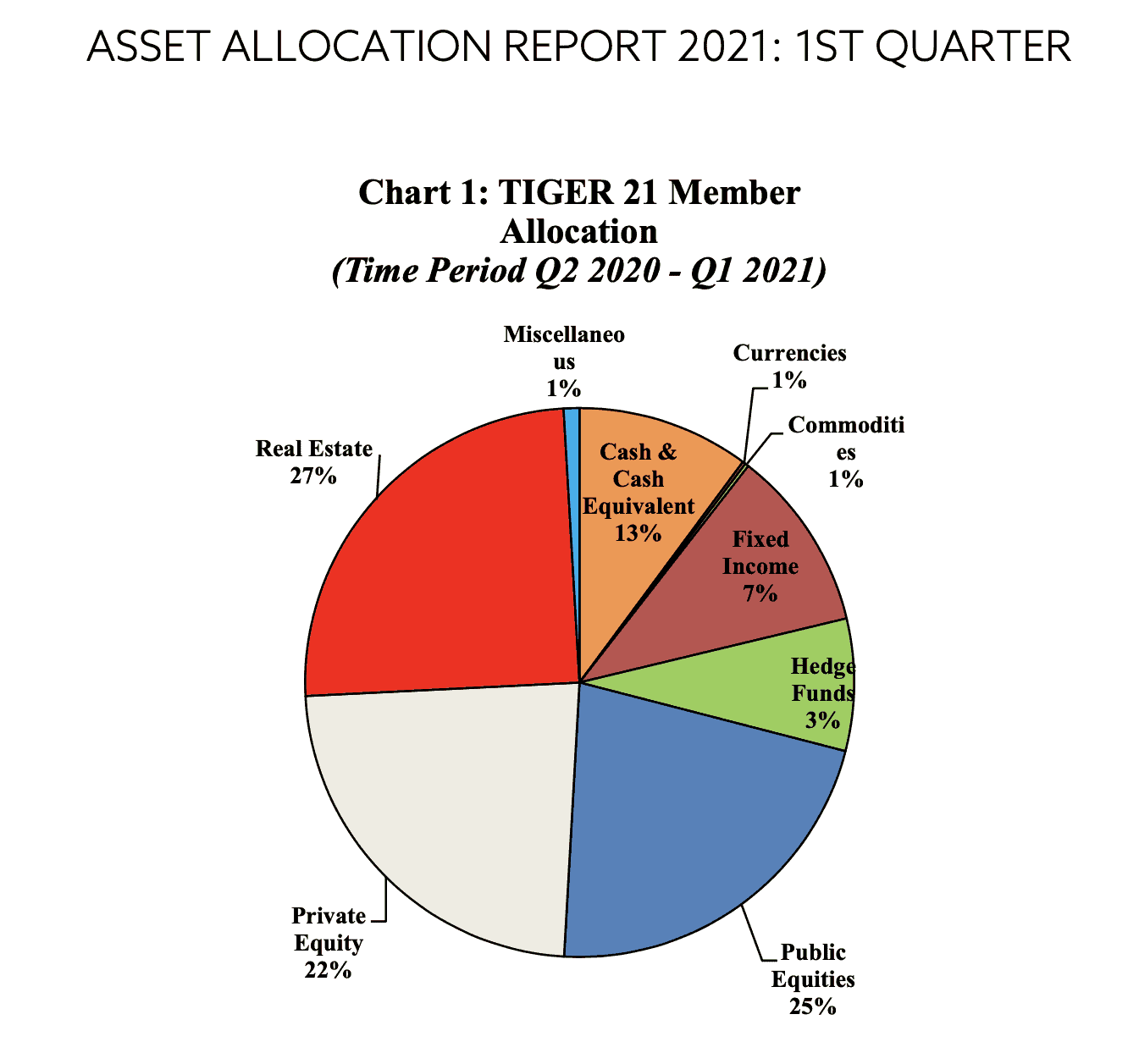

Consider the asset allocation of the ultra-wealthy members of the social investing club Tiger 21:

In the first quarter of 2021, the members of Tiger 21 allocated 27% of their assets to real estate – commercial real estate.

2021 is not an anomaly as the members of Tiger 21 consistently allocate 25% or more to commercial real estate every year.

Is it effective?

Since the members of Tiger 21 are all required to SHOW a minimum of $50 million in investable assets to join and remain in the club, their asset allocation strategy – with a heavy emphasis on real estate – must be working.

Late billionaire and former owner of the Tampa Bay Buccaneers (forgive me) and English football club Manchester United once said:

“If you want to know the road ahead, ask the person who’s been there.”

If you want to be like the ultra-wealthy, invest like the ultra-wealthy. Look at their allocations if you want to know how much of your portfolio should be in real estate.

What you’ll find is that they consistently make real estate their top priority – always allocating 25% or more of their portfolios to this valuable asset class.