Anyone who was hoping to retire in 2022 and live off their 401(k)’s or IRA’s allocated to mutual funds has gotten a slap to the face this year thanks to a volatile stock market borne of inflation, rising interest rates, gas prices, war, political turmoil, and the list goes on.

If you started the year with $100k in your 401(k), that 401(k) is now worth $84,000.

Here’s why:

A common reaction from investors is to shrug off massive losses in a short period.

In 2008, it only took months for the stock market to shed 50% of its value following the whole debacle surrounding mortgage-backed securities and the real estate crash. It took seven years for the market to recover. It was not lightning quick.

Back to our 401(k) example, there’s another problem with being in a 16% hole beside the time it will take to get out of it.

A common misbelief is that the stock market must bounce back 16% to make the 401(k) whole again. Right? Not exactly. That’s because, after the decline, you now have less to work with and will need a gain greater than the original loss to become whole.

Let me illustrate.

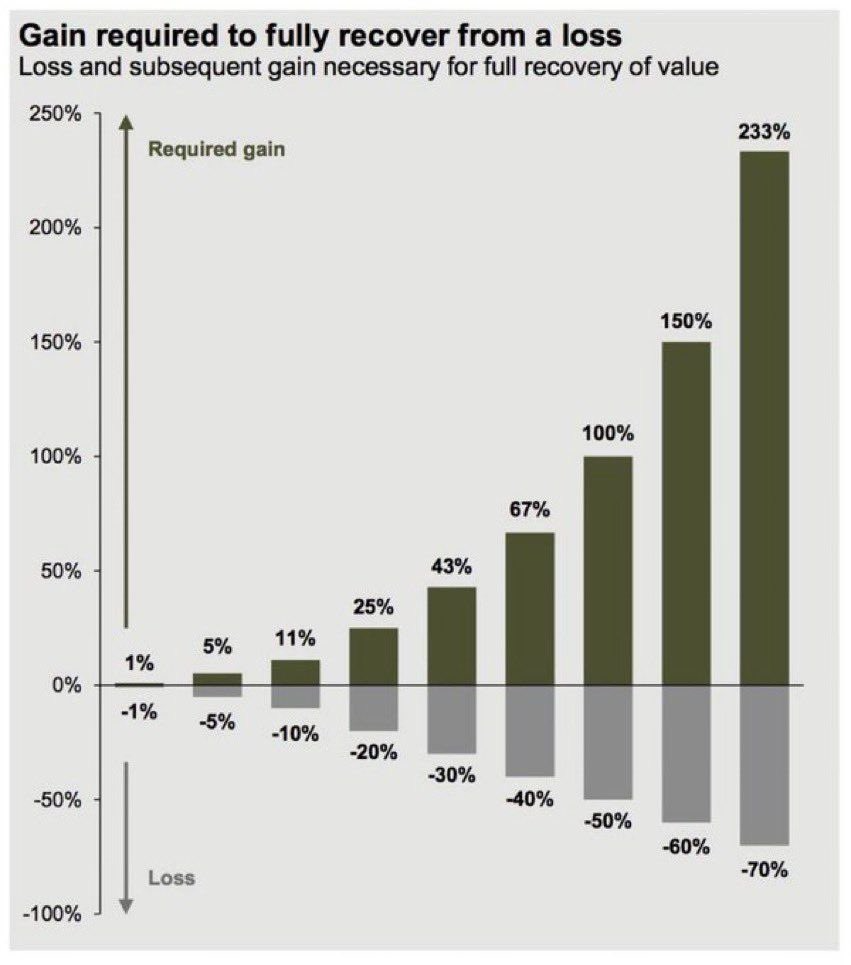

Check out the following chart:

Source: Twitter @AndreasSteno

This chart provides a sliding scale of what your portfolio will need to gain to get back to ground zero after a certain percentage loss. It’s saying that if your 401(k) declines, it will take more than a 16% rebound to get back to normal. The thing that stands out most about this chart is that the deeper the slide, the more difficult it becomes to get back to where you started.

For example, while a 10% loss requires an 11% gain to get back to normalization, if you continue to stick to your guns and let your losses deepen to 30%, you will now need a 43% gain to recover. The difference in gain required between a 10% and 30% loss is 32% (43%-11%). Now, look at the jump in gain required between a 30% loss and a 50% loss. That difference is now 57% (100%-43%).

The longer you stay in, the deeper the hole it will take for you to climb out.

Here’s the kicker: Anyone retiring in 2022 will likely have to dip into their 401(k) to make ends meet. In that case, the road to recovery becomes even more daunting.

Here’s how:

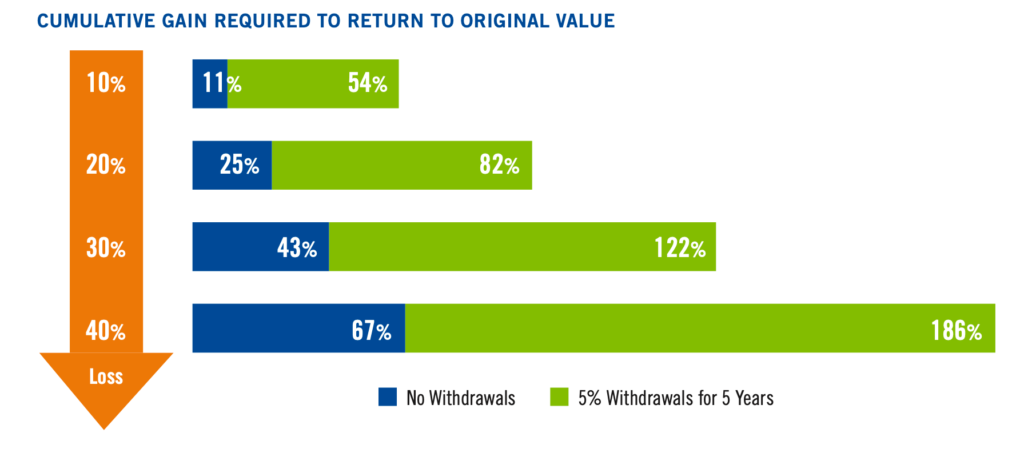

Source: franklintempleton.com

The chart above illustrates the consequence of having to take withdrawals from a portfolio over five years. Being highly conservative, if you take an average of 5% a year in withdrawals, the difficult road to recovery becomes even more treacherous. Now a 30% loss that once required a 43% rebound to recover now requires a nearly impossible 82% in gains to recover when accounting for withdrawals.

Many investors will argue that the stock market recovered from the COVID-induced crash just as quickly as it dropped. COVID was a unique situation, as the economy was fundamentally strong before the pandemic hit. Unemployment was at record lows, GDP growth was strong, and fuel prices were low. The market, which crashed due to social distancing and lockdowns, quickly recovered thanks to stimulus checks and the easing of lockdowns.

Amid the current bear market, the state of the economy is in flux. The same stimulus checks that fueled the recovery in 2020 are now coming back to bite the markets in the form of inflation – a problem not likely to go away soon.

Although it’s not all bad with the economy, I just expect them to get worse from here. There will be no stimulus checks to come to the rescue this time, and Corporate America is pessimistic, with a majority of CFOs from top corporations and organizations predicting a recession within the next year.

We’ve established that the road to recovery from losses is perilous. With losses predicted only to go deeper, wouldn’t it be better to avoid them than to slide deeper and face a daunting road to recovery?

It’s better to avoid losses than recover from them.

Savvy investors would rather avoid losses than recover from them. For starters, they allocate more of their portfolios to the private markets to minimize the effects of public market volatility susceptible to the slightest disturbances – whether due to economic drivers or just from buzz and chatter from the internet and social media.

By allocating to private investments, they minimize the effects of irrational market drivers by locking their capital up in long-term assets that have a history of performing through recession and inflation. Affordable housing and essential businesses are examples of private alternative assets that meet these criteria.

Avoid recovering from losses. Consider private alternatives for avoiding those losses.