When I first read the headline below, I immediately thought that someone screwed over Messi – either through extreme competence or by fraud. Either way, he probably could have avoided disaster if he had vetted his partner(s) properly.

Lionel Messi spent $35 million on a hotel facing demolition and only found out about the problem when a Spanish newspaper asked him for comment. –insider.com

I can only assume Messi teamed up with somebody to buy the hotel because, like with most active professional athletes – especially one of Messi’s stature – who don’t have the time, knowledge, or experience to acquire and operate a commercial property like a hotel themselves, they have to rely on so-called experts to do the work for them.

Someone somewhere led Messi astray – either through extreme incompetence or fraud. Either way, Messi lost $35 million, and he’ll likely never get it back because there’s no such thing as negligence insurance.

Messi is worth a lot of money, and like other people with a lot of money, he’s not content to sit on his pile of cash. He wants to grow his wealth like others in his position.

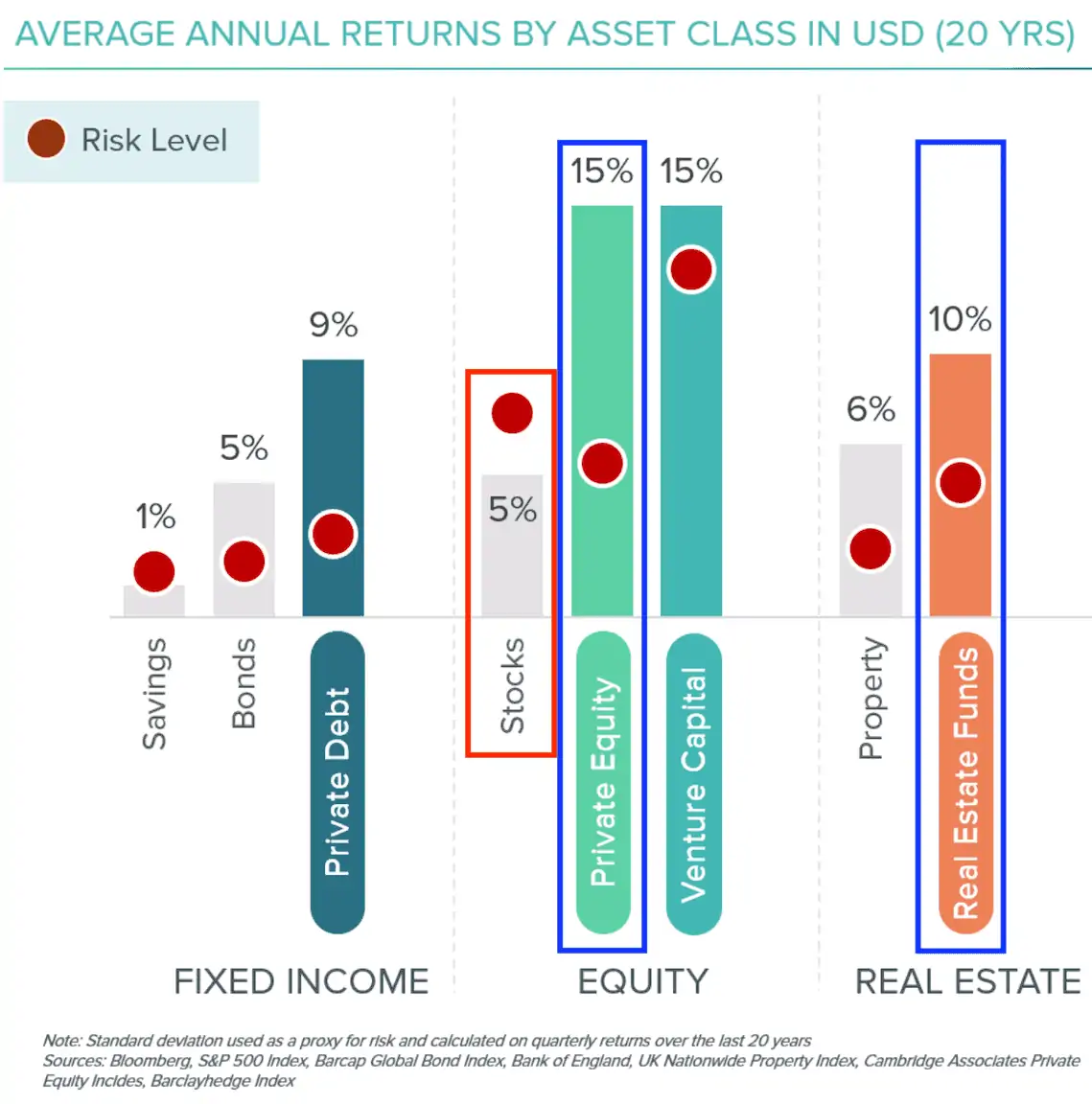

You can’t blame him for wanting to get into commercial real estate. After all, commercial real estate and private investments (i.e., private equity) offer some of the highest risk-adjusted returns of any asset class. That’s why the wealthy allocate a majority of their portfolios to these two asset classes while the average investor allocates a majority to public stocks and bonds.

Most investors don’t have the time, experience, knowledge, infrastructure, and personnel to invest in a diverse portfolio of assets across multiple geographic markets.

To overcome these hurdles, they partner with multiple experts where, as limited partners, the investor contributes the financial capital and the general partner contributes “everything else” to acquire a specific asset (i.e., co-investment).

Items in the “everything else” basket you would hope to see from a potential investment partner is “A” grade in the areas of experience, knowledge, track record, infrastructure, and the team.

The value of co-investing is immeasurable. By leveraging the expertise of seasoned professionals, you can achieve a diversified portfolio that generates above-market risk-adjusted returns to buy back your time and pursue your passions. At the same time, someone else does the heavy lifting.

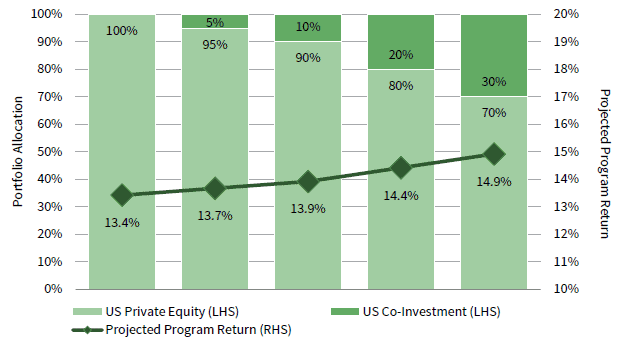

The value of co-investing (partnering with experts to acquire specific assets) is backed by data:

The more investors allocate their portfolios to co-investment arrangements, the better the returns. Messi undoubtedly entered into one such co-investment arrangement to acquire the hotel. Things didn’t go as planned.

Screen potential partners to mitigate risk. Co-investing can be highly profitable, but it can also be fraught with risk. The key is to team up with the right partners.

What are the areas you should scrutinize when screening potential partners?

- Experience – both general and asset-specific.

- Knowledge – of the asset class as well as geographic markets.

- Processes – internal processes for handling the entire investment lifecycle from soliciting capital to sourcing assets, due diligence, acquisition, operations, and disposition.

- Track Record – with both capital raising and investing. You should never invest in someone’s first rodeo.

- Infrastructure – operations, technology, marketing, and administrative backbone necessary for carrying out day-to-day operations as well as overall execution of the company’s business plan.

- Team – qualified team of managers, advisors, employees, and staff – all designated for efficient execution of the investment strategy.

- Financials – only clear, detailed financial projections will do. Avoid partners who speak in vagaries. Make sure they have clear, easy-to-follow financial projections and data to back up all their claims.

I guess that Messi didn’t properly screen his investment partner and that his partner was probably a solo hack doing his first deal. Messi could have avoided all this by asking the right questions.

Don’t be afraid to delve into a potential investment partner’s experience, knowledge, processes, track record, infrastructure, team, and financials.

Make sure you’re partnering with a solid team with the requisite experience, knowledge, infrastructure, and personnel needed to maximize your probability of success.

Doing so could save you a lot of heartburn but, more importantly, help you achieve your wealth-building goals.