In these uncertain economic times, how resilient is your portfolio?

How resistant to potential black swan events or other economic risks – seen and unforeseen – is your portfolio?

In times of market volatility, investors scramble to preserve capital by allocating from volatile assets to more stable assets. Think of your portfolio as stacks of $100 bills. A portfolio allocated to volatile assets like stocks and crypto wreaks havoc on this pile of cash as the pile shrinks. It grows almost daily – while continually trending downward in uncertain economic times.

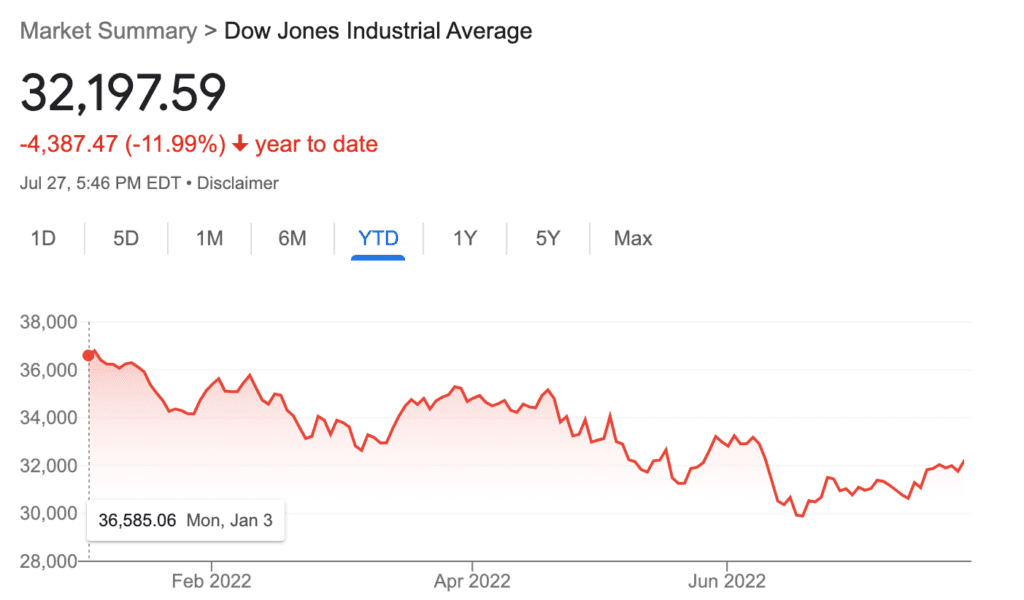

Witness the market volatility of stocks and Bitcoin since the beginning of the year:

In times of uncertainty and extreme volatility, investors put a premium on capital preservation and stability – maintaining that pile of cash while experiencing calm among the storm.

In the past, assets and strategies investors turned to for capital preservation have included:

- Checking and Savings Accounts.

- Money Market Accounts.

- Certificates of Deposits (CDs).

- Treasuries.

- Stuff Under a Mattress.

Here’s the problem with traditional forms of capital preservation in our current economic environment: Runaway inflation doesn’t make these options feasible.

Back to our stack of money. If you simply left the pile of money alone (i.e., stuff money under a mattress), that pile will shrink by 9.1% annually based on the latest inflation numbers released in June. The other options are not much better where low rates that these options pay are far outpaced by inflation.

With top CDs paying around 3.35%, Money Market Accounts paying the best rates of 1.10%, High-Yield Savings Accounts paying about 1.52%, and 10-year treasuries paying a rate that sits at 2.77%, in the best case scenario with CDs paying 3.35%, your portfolio will lose 3.35% annually. That is not exactly capital preservation.

Capital preservation is not one-dimensional. It requires a multi-pronged attack to achieve portfolio resilience.

These are the strategies savvy investors adopt for preserving capital and building resilient portfolios:

- Long-Term Growth.

- Passive Income.

- Alternative Assets.

Long-Term Growth –

Capital can be preserved by neutralizing short-term fluctuations with long-term stability by focusing on assets with an eye on long-term growth.

Commercial real estate (CRE) has long established its resilience in the face of adversity. As long as investors are willing to sacrifice liquidity, CRE has long proved its value as a resilient asset that rebounds from short-term hiccups better than any other asset class. The early days of the pandemic proved damaging to most industries, including CRE, but CRE rebounded quickly, with most segments already having made a full recovery.

Passive Income –

Passive income that keeps pace or even exceeds inflation is the ideal counter to the diminishing effects of inflation on your portfolio. As inflation chips away at your money pile, putting money back on that pile faster than inflation is the key to capital preservation.

Certain segments of CRE have not only proved resilient. Still, they have thrived in recessionary and inflationary times, with rents keeping pace or exceeding inflation without any declines in vacancies.

Alternatives –

Alternative assets like CRE insulate portfolios from the volatile fluctuations of the broader markets. Illiquid assets like CRE uncorrelated to Wall Street insulate portfolios from wild market swings triggered by herd behavior.

Alternatives are ideal for insulating against market triggers such as geopolitical turmoil, wars, gas prices, economic indicators, or any other trigger from the internet, social media, and on-demand news.

Allocating to alternative assets has long been a strategy of smart investors for preserving capital and achieving peace of mind.

Making your portfolio resilient and insulating it from rapid drops and market volatility requires a three-prong approach to preserving capital.

Traditional havens for preserving capital will not cut it in today’s hyperinflation environment, where inflation swallows up any nominal gains generated by assets such as CDs, MMAs, treasuries, and savings accounts. Capital preservation requires thinking long-term, thinking outside the box, and looking for alternatives.

CRE has long been a reliable haven from downturns and inflation and a valuable asset in the quest for capital preservation. In some instances, and with allocations to the right segments, investors can even go beyond capital preservation and create capital growth.