The current uncertainty in the markets is wreaking havoc on the stock and crypto markets.

UNCERTAINTY = VOLATILITY

VOLATILITY = RISK

RISK = LOSSES

The elements that drive market volatility – inflation, rising interest rate, fiscal policy, geopolitical turmoil, social media, and social turmoil – are all currently in play. The result has been constantly up and down – mostly down – markets with charts that read like an EKG.

The current volatility has resulted in big losses for many investors. The Dow is down nearly 11% year-to-date, while Bitcoin is down almost 39%. All that despite not officially being in recession territory yet. As the volatility drags on, predictions of an impending recession are gaining momentum by the day.

Smart investors have been recession-proofing their portfolios with recession-resilient assets for decades.

What type of assets are recession-proof?

Tangible assets like CRE have long been turned to for their resilience in the face of uncertainty, volatility, downturns, and inflation.

Unlike public equities, resilient assets like CRE can sustain tenant demand and support rents, underlying values, and ultimately returns for investors. It is these types of assets that are best suited to weather shocks. Still, while some CRE segments are ideal for shielding the effects of downturns and inflation, others thrive and even offer investors the opportunity to get wealthy during a recession.

One CRE segment that thrives during downturns and is poised to be in even more demand during the next recession is manufactured (or mobile) home communities (“MHCs”).

While some CRE sectors are cyclical, with some sectors more correlated to the broader economy than others (i.e., retail and office), MHCs are less correlated and thrive during recessions.

For example, during the pandemic-induced downturn, MHCs saw occupancies and rents increase – a fact not lost on institutional investors flocking to the segment. During the Great Recession, while single-family housing values plummeted, the affordable housing sector thrived, including affordable multifamily and MHCs.

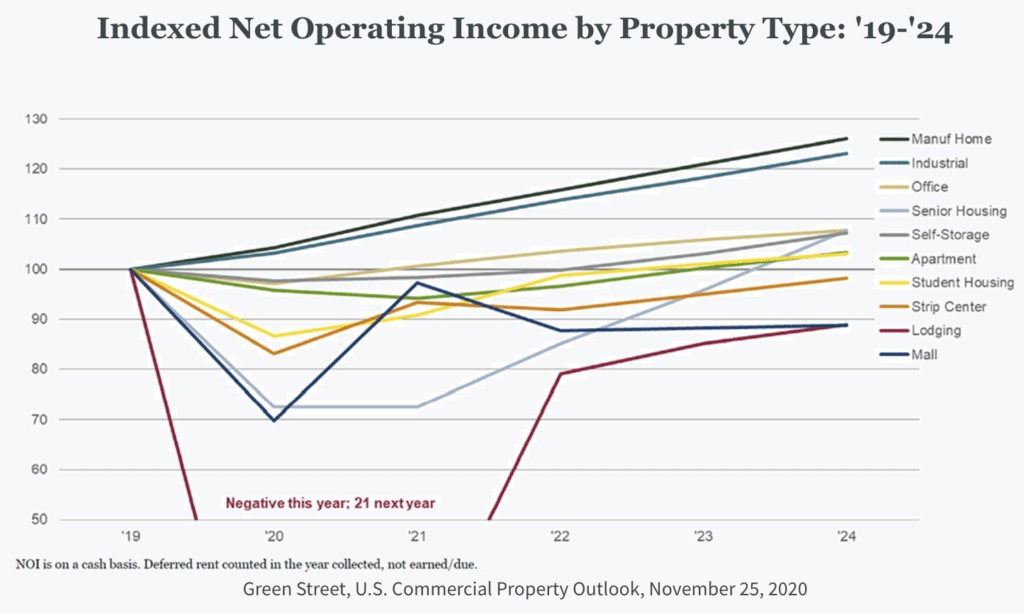

According to Green Street Advisors, based on NOI, the MHC sector has been an all-star performer since the COVID-induced downturn and is expected to continue to outperform all other sectors through 2024.

Rising rents and rising occupancy are the ideal elements for weathering a recession and thriving during one.

MHC demand is expected to remain strong in the face of inflation, putting it in an ideal position to make investors wealthy during the next recession as current homeowners, as well as renters in the mid to upper levels of the multifamily sector, downsize in the face of job losses and retracting buying power due to inflation.