In a speech given last week at the PLI Investment Management Institute 2020, Dalia Blass, the Director of the Division of Investment Management at the SEC made a stunning suggestion:

Individual investors need more access to private markets – specifically through their 401k’s.

You can read the transcript here.

Speaking of the many initiatives her division is currently working on, Ms. Blass noted one particular initiative “that has been important over the last several months. That initiative is enhancing public access to private markets.”

According to Ms. Blass, once prominently defined benefit plans (i.e., pension plans or qualified-benefit plans), which traditionally included private investments as part of their investment strategy as institutional investors, the same can not be said of defined contribution plans (401(k)s and 403(b)s), which have eclipsed pension plans in prominence but ignore the private markets in favor of mutual funds. “As a result, Main Street investors are increasingly on the outside looking in.”

Why are private markets a big deal?

According to Ms. Blass:

“Private investments have the potential to provide stronger returns and diversification for investors, but come with both performance and liquidity risks. Defined benefit plans utilize potentially advantageous returns while seeking to manage those risks.”

Maybe it’s no coincidence that Ms. Blass’ speech comes at a time when many 401(k) participants saw their portfolios plummet in the onslaught of the COVID-19 pandemic. It’s been a roller coaster ever since.

Without getting into how Ms. Blass suggests private markets be made more accessible to you, the individual investor, through their 401(k)’s, the message is clear: private investments should be a bigger part of your asset allocation.

The value of private investments in alternatives like private equity, commodities, and commercial real estate is nothing new to institutional investors like private pension plans and university endowments. They have known for decades that private investments in alternatives offer cash flow, capital growth, and asset preservation which are vital in recessionary times for economic survival.

One successful institutional investor that has long used private investments to its advantage is the Yale University Endowment.

The Yale Model, named for the Yale Endowment investment strategy is heavily invested in recession-resistant alternative investments.

For example, commercial real estate is at the top of Yale’s priorities with an allocation consistently above 12%.

Commercial real estate offers far superior returns while protecting against downturns since the right alternatives have a low correlation to the broader markets.

There’s proof that this alternative-heavy strategy is recession-resistant.

For example, in 2018, while the S&P was down 4.38%, the Yale Endowment reported a return of 12.3%.

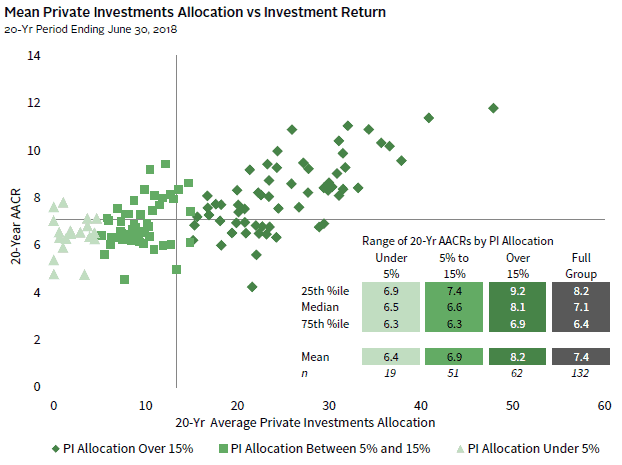

A recent study by Cambridge Associates (“CA”), a private investment firm, reinforces the value of private investments in an investment mix.

The CA study found that private investments have provided the strongest relative returns for decades, and top-performing endowments like the Yale Endowment and other institutions have been long-time allocators to private investment strategies, reaping the benefits of the outperformance.

Private Investing for Private Investors: Life Can Be Better After 40(%). (2019, February) www.cambridgeassociates.com.

CA’s past analysis indicates that endowments and foundations in the top quartile of performance had one thing in common: a minimum allocation of 15% to private investments. CA data also showed that the top 10% steadily increased their allocations over the past two decades, exceeding 15% of allocations, in many cases, exceeding 40%.

The CA data also shows a clear positive correlation between returns and allocation percentages to private investments as evidenced by the following chart:

It looks like the SEC is trying to level the playing field for you, the individual investor, by making private investments more accessible to reap the same benefits institutional investors have been enjoying for decades. And through risk-mitigating measures like vetting management and diversification, which can be accomplished across a variety of factors including:

- Alternative Class.

- Stage of Development.

- Security Type.

- Type of Return.

- Holding Period.

- Geographic Location.

Achieving above-market risk-adjusted returns are not just possible but probable.

Take the SEC director’s recommendation and invest in the private markets.